VET-DEFENDER

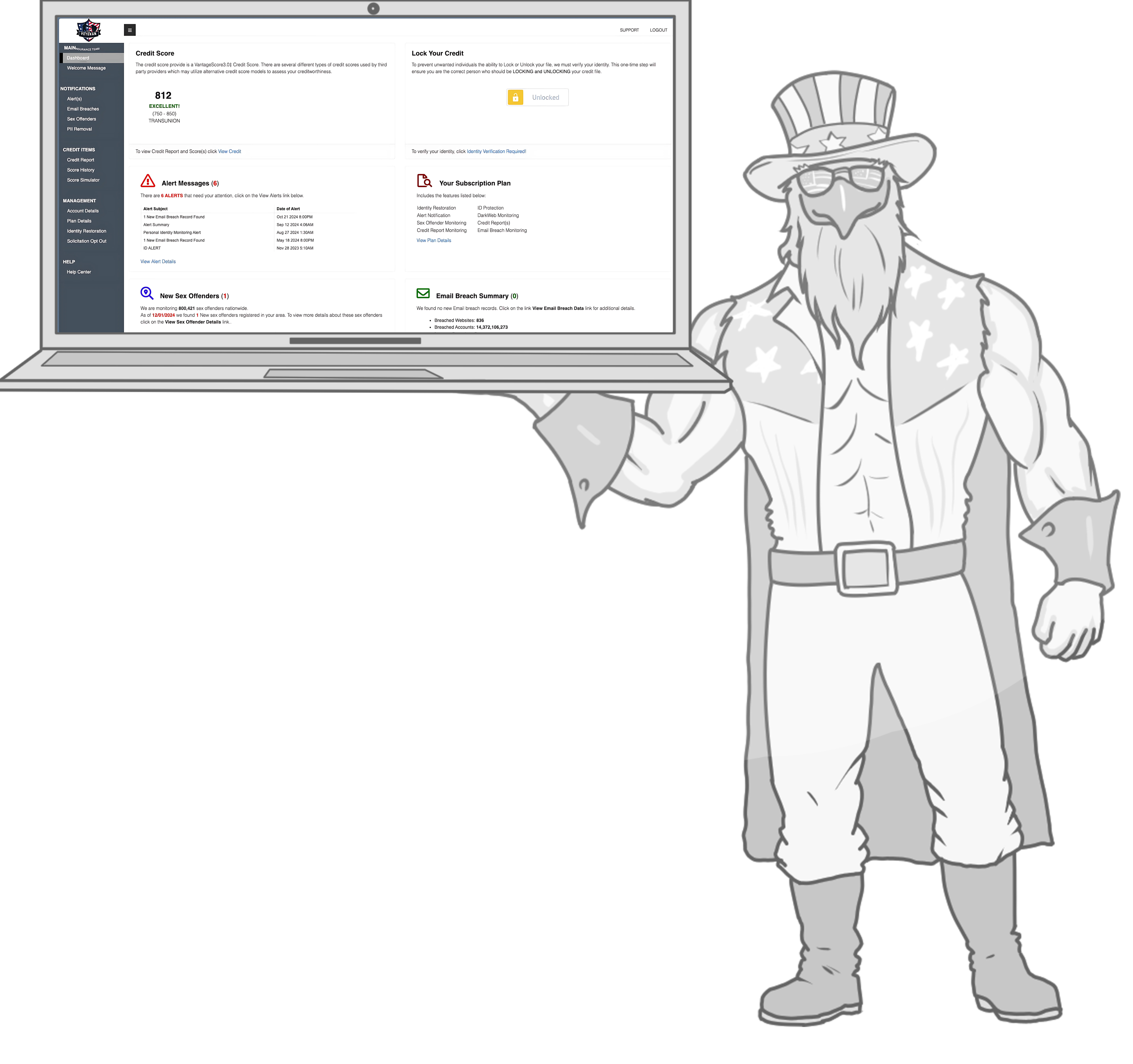

POWERED BY DEFEND-ID

Protect your Name, Credit. Home’s Title, Business and more!

Same protection as the big guys, but at a fraction of a cost for Veterans!

Did you know?

There's a victim of identity theft in the U.S. every 3 seconds.**

More than 63 million Americans have been affected by identity theft.

Over $29 billion was stolen by identity thieves in 2022.***

We monitor your credit, the dark web, and so much more all day, every day... so you don't have to!

If we detect any changes, or anything strange, we'll alert you immediately via email and text.

If your identity is compromised, a Veteran will take over every step of the recovery process and stick with it until full recovery is achieved.

Your Vet-Defender comes with up to $1,000,000 of insured coverage.. because the last thing you want to worry about is how you're going to pay to get your good name back!

Vet-Defender for you and your family

By the numbers. An indepth look at what's covered by Vet-Defender!

FULLY MANAGED RECOVERY

Fully managed recovery provides the peace of mind of a dedicated certified Recovery Advocate. The advocate works on borrower's behalf to perform all of the necessary tasks to restore their identity, including completing and filing forms, conducting research and contacting all relevant companies, agencies and financial institutions to ensure that any identified fraudulent activity is addressed and resolved.

AUTHENTICATION

Continued assurance that the person logging into the vet-defender system is your borrower.

CRIMINAL DATA MONITORING

Monitor millions of criminal and civil court records for your personal information to validate that it has not been used to commit a crime.

CREDIT REPORT WITH SCORE

Continued assurance that the person logging into the vet-defender system is your borrower.

ADDRESS CHANGE MONITORING

Monitors the United States Postal Service for any updates to your address and alerts when changes have been made.

THREE BUREAU CREDIT MONITORING

Receive alerts within 24 hours for new activity such as credit inquiries, new credit lines, derogatory credit, and name or address changes, to name a few.

CHILDREN PUBLIC RECORDS MONITORING (Family Plan)

Monitors millions of public and private database records for information related to your child to let you know if any of their personally identifiable information is being used by identity thieves.

INSTANT INQUIRY ALERTS

Instant inquiry immediately alerts you when a creditor requests your report at TransUnion. You will receive an email as soon as TransUnion receives the request.

CREDIT VALUE & LOST DOCUMENT REPLACEMENT

Lost wallet or purse? Secure online storage is available for up to 50 pieces of personal information, including credit cards, checking and savings accounts, personal loan information, passport details, retirement accounts, certifications, licenses, and more!

CREDIT SCORE TRACKER

Instant inquiry immediately alerts you when a creditor requests your report at TransUnion. You will receive an email as soon as TransUnion receives the request.

$1,000,000 ($25,000 Gold Plan) REIMBURSEMENT INSURANCE

Covers expenses you may incur during the recovery of your identity, including long distance telephone calls, postage and handling fees, fees for notarizing affidavits, document, filing fees for grants or credit applications rejected as a result of a Stolen Identity Event. Lost wages due to time off from work are also covered.

DARK WEB MONITORING

An intelligent and proactive identity theft detection solution that searches for compromised information across the deep, dark, and surface web, as well as underground forums and file sharing sources.

PEACE OF MIND WITH A PLACE TO TURN

IDENTITY MONITORING PUBLIC RECORDS

Monitors millions of public and private database records to identify possible instances of id theft and will alert you of changes that may indicate an identity thief is using your info to access an existing account or applied to open a new account in your name.

Vet-Defender for your Home

Receive notifications for changes in property ownership, a new lender is detected, a loan associated with your property was refinanced, or notice of default on your property.

How could someone steal my home?

Thanks to digitization, everything a thief needs can be easily accessed online.

What happens when my title is stolen?

Fake documents are filed with your county, transferring your title out of your name.

What can a criminal do with my title?

The scammer uses the equity in your home to take out loans or even sells the home.

How can a bank foreclose if it was fraud?

The criminal and the cash are gone. You are now faced with a financial and legal nightmare of proving you are the victim of a crime.

Receive notifications for changes in property ownership, a new lender is detected, a loan associated with your property was refinanced, or notice of default on your property.

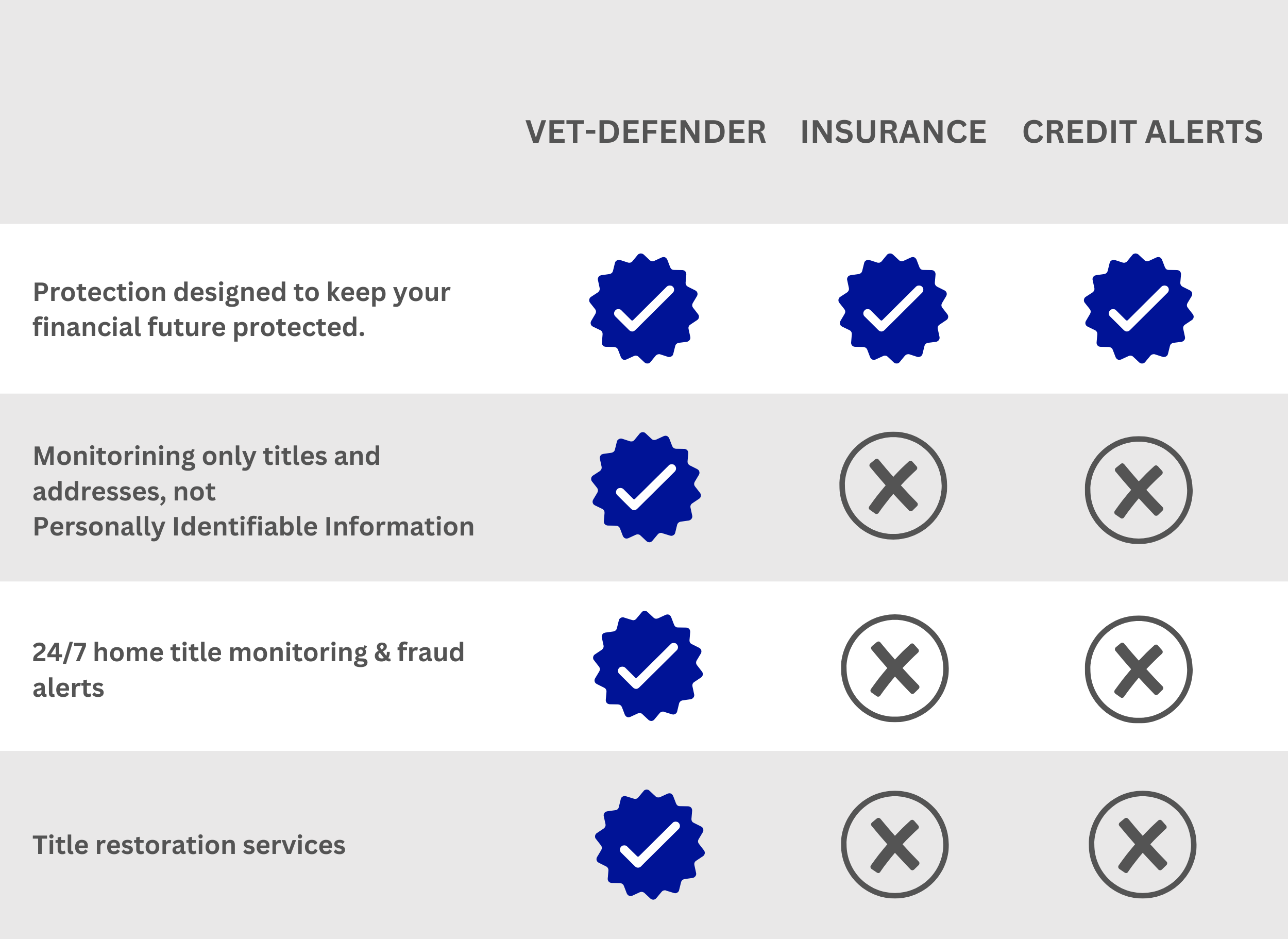

VET-DEFENDER

INSURANCE

CREDIT ALERTS

Protection designed to keep your financial future protected.

Monitorining only titles and addresses, not Personally Identifiable Information

Monitorining only titles and addresses, not Personally Identifiable Information

Title restoration services

How could someone steal my home?

Thanks to digitization, everything a thief needs can be easily accessed online.

What happens when my title is stolen?

Fake documents are filed with your county, transferring your title out of your name.

What can a criminal do with my title?

The scammer uses the equity in your home to take out loans or even sells the home.

How can a bank foreclose if it was fraud?

The criminal and the cash are gone. You are now faced with a financial and legal nightmare of proving you are the victim of a crime.

Vet-Defender for your Business

These days every service you sign up for claims some kind of "cyber" protection. But don't be fooled, these coverages have huge gaps in coverage and most never even address regulatory compliance. This is where defend-id comes in. We don't just prepare you; we protect you, your employees, your customer relationships and your entire business.

- ◯ Regulatory experts ensure your business is in compliance

- ◯ Access to an AmLaw 100 law firm in the case of a breach

- ◯ Dedicated fellow Veteran turned fraud specialist

- ◯ No deductibles

- ◯ 100% identity fraud restoration success rate

Vet-Defender

Law Retainer

Cyber Insurance

Domain Monitoring

Compliance Consultant

Security and Response Planning

Business Fraud Remediation

Dark Web Monitoring

Employee Faculty Managed Identity Rcecovery

Regulatory Response & Client Notification

Insurance Reimburs

ement

Breach Readiness and Response Planning

Dark Web Monitoring

Business Fraud Remediation

Employee Identity Fraud Fully Managed Recovery

Regulatory Response and Client Notification

Customer Identity Fraud Fully Managed Recovery

Simple. Transparent. Easy.

Everything you come to expect from us.

PRODUCT FEATURES

Fully Managed ID Theft Recovery Services

Authentication Service

Credit Report with Scores

Annual TransUnion Credit Report with Score

Annual Three Bureau Credit Report with Scores

Credit Monitoring

1 Bureau Credit Monitoring with Daily Alerts

3 Bureau Credit Monitoring with Daily Alerts

Instant Alerts

Score Tracker

Non-Credit Monitoring

Internet Dark Web Monitoring

SSN Monitoring

Criminal Data Monitoring

Address Change Monitoring

Child Public Record Monitoring (Family Plan Only)

Lost Document Replacement

Credential Vault

Expense Reimbursement

$1,000,000 with Unauthorized Electronic Funds

$25,000 with Unauthorized Electronic Funds

GOLD

PLATINUM

Monthly Cost

Mortgage Protection

Small Business

$12.95/MO/Individual

15.95/MO/Family

12.95

15.95

$16.95/MO/Individual

21.95/MO/Family

Circle Up... For some Frequently Asked Questions

Simplicity is one of the tenets after VetLife so lets break this down Barney style.

What is identity theft?

Identity theft happens when criminals steal your personal information to take control of your accounts, open new ones, file false tax returns, rent or buy properties, or carry out other illegal activities in your name. This is like an enemy trying to take over your life and use your identity for their own gain.

• Tax-Related ID Theft

• Medical ID Theft

• Social Security ID Theft

• Stealing From Your Savings and

Investment Accounts

• Opening New Accounts

Could it happen to you?

It can strike in many ways—whether it's through a data breach, ATM overlays, shoulder surfing, or stolen mail. Just like every soldier has a unique identity, anyone can be vulnerable to this attack. Here are some key facts about identity theft:

• A new victim of identity theft is targeted every 2 seconds

• Nearly 1 in 4 individuals will face identity theft in their lifetime

• In 2018, identity theft cost victims nearly $14.5 billion

Just like in the field, you have to stay vigilant to protect what’s yours.

What do I need to enroll?

Enroll through your benefits program during the enrollment period and provide the following details:

• Legal Name

• Date of Birth

• Address

• Social Security Number

• Phone Number

• Email Address

Once you’re enrolled, you’ll receive a welcome email with instructions to set up your account. Stay mission-ready and secure your benefits.

How do I know my personal information is secure?

Your personal information is a priority, and we’ve deployed a multi-layered defense strategy to keep it protected. Just like securing a base, we encrypt your data both in transit and at rest, using top-tier encryption technology to safeguard it.

We maintain a constant watch, with proactive monitoring and advanced tools in place to defend against unauthorized access. We also partner with trusted allies to stay ahead of evolving threats and undergo annual audits to ensure our security and privacy practices are always up to military-grade standards. Your information is in safe hands.

Will identity theft affect my credit score?

Yes, identity theft can leave a lasting impact on your credit score. If unauthorized charges are posted to your account and you fail to take action, your credit history could take a hit.

If you’ve been compromised, we recommend locking or freezing your credit file. Think of it as putting your financials in a secure, unbreachable vault. A credit freeze limits access to your credit report, preventing identity thieves from opening new accounts in your name.

Stay proactive, stay protected.

Which credit bureaus do you monitor?

We keep a sharp eye on your credit across all three major credit bureaus—Experian, Equifax, and TransUnion. We will alert you to any new inquiries on your file.

Think of it like having all your intel in one mission report.

How does identity theft

can happen?

Today’s cybercriminals can breach a company’s database or raid the Dark Web to steal valuable intel. This stolen data can include everything from passwords and credit card info to Social Security numbers—essentially anything you’ve entrusted to online platforms. It’s like your personal security being compromised behind enemy lines.

Visiting unfamiliar websites, clicking on suspicious links, or using unknown USB devices can expose you to malware. Hackers use malicious software, like ransomware, to access your devices, steal your data, and even hold it for ransom. To protect yourself, always use a trusted antivirus solution and add a secure VPN for safer browsing on public Wi-Fi networks. Think of it as adding extra layers of defense to keep your information safe.

These attacks often come through emails, text messages, or DMs on social media from unknown senders. They try to trick you into “confirming your identity” or “proving it’s really you” by asking for your username and password. Identity thieves are even targeting kids on social media and gaming platforms. Once they gain access to accounts, they can commit fraud while posing as you. In the worst-case scenario, they might get into your online banking and drain your account, creating a nightmare to recover stolen funds.

To stay safe, avoid opening spam emails and never click on unfamiliar links.

Losing your wallet can do more damage than you think if it ends up in the wrong hands. A thief could use your driver’s license or Social Security card to commit identity theft. Criminals might also target your physical mail to get their hands on sensitive financial details, like your bank account number. One common tactic is change-of-address fraud, where they reroute your mail to steal your information without you knowing.

Remember, everything you do online leaves a digital footprint, and in some cases, a criminal only needs your email to access your personal information. Stay vigilant—whether it's protecting your wallet or guarding your online activities, keep your defenses up.

Can you prevent 100% of the risk of identity theft and fraud?

While it can be difficult to detect identity theft until it’s too late, there are tactical steps you can take to reduce the risk. No service can eliminate all threats, but with our combination of advanced tools and strategic monitoring, we can detect and alert you to potential credit fraud up to 250X faster than our competitors.

Think of it as having a vigilant lookout, spotting threats before they reach your perimeter.

Identity theft happens when criminals steal your personal information to take control of your accounts, open new ones, file false tax returns, rent or buy properties, or carry out other illegal activities in your name. This is like an enemy trying to take over your life and use your identity for their own gain.

• Tax-Related ID Theft• Medical ID Theft

• Social Security ID Theft

• Stealing From Your Savings and

Investment Accounts

• Opening New Accounts

It can strike in many ways—whether it’s through a data breach, ATM overlays, shoulder surfing, or stolen mail. Just like every soldier has a unique identity, anyone can be vulnerable to this attack. Here are some key facts about identity theft:

• A new victim of identity theft is targeted every 2 seconds

• Nearly 1 in 4 individuals will face identity theft in their lifetime

• In 2018, identity theft cost victims nearly $14.5 billion

Just like in the field, you have to stay vigilant to protect what’s yours.

Enroll through your benefits program during the enrollment period and provide the following details:

• Legal Name

• Date of Birth

• Address

• Social Security Number

• Phone Number

• Email Address

Once you’re enrolled, you’ll receive a welcome email with instructions to set up your account. Stay mission-ready and secure your benefits.

Your personal information is a priority, and we’ve deployed a multi-layered defense strategy to keep it protected. Just like securing a base, we encrypt your data both in transit and at rest, using top-tier encryption technology to safeguard it.

We maintain a constant watch, with proactive monitoring and advanced tools in place to defend against unauthorized access. We also partner with trusted allies to stay ahead of evolving threats and undergo annual audits to ensure our security and privacy practices are always up to military-grade standards. Your information is in safe hands.

Yes, identity theft can leave a lasting impact on your credit score. If unauthorized charges are posted to your account and you fail to take action, your credit history could take a hit.

If you’ve been compromised, we recommend locking or freezing your credit file. Think of it as putting your financials in a secure, unbreachable vault. A credit freeze limits access to your credit report, preventing identity thieves from opening new accounts in your name.

Stay proactive, stay protected.

We keep a sharp eye on your credit across all three major credit bureaus—Experian, Equifax, and TransUnion. We will alert you to any new inquiries on your file.

Think of it like having all your intel in one mission report.

Data Breaches

Today’s cybercriminals can breach a company’s database or raid the Dark Web to steal valuable intel. This stolen data can include everything from passwords and credit card info to Social Security numbers—essentially anything you’ve entrusted to online platforms. It’s like your personal security being compromised behind enemy lines.

Viruses & Malware

Visiting unfamiliar websites, clicking on suspicious links, or using unknown USB devices can expose you to malware. Hackers use malicious software, like ransomware, to access your devices, steal your data, and even hold it for ransom. To protect yourself, always use a trusted antivirus solution and add a secure VPN for safer browsing on public Wi-Fi networks. Think of it as adding extra layers of defense to keep your information safe.

Phishing Attacks

These attacks often come through emails, text messages, or DMs on social media from unknown senders. They try to trick you into “confirming your identity” or “proving it’s really you” by asking for your username and password. Identity thieves are even targeting kids on social media and gaming platforms. Once they gain access to accounts, they can commit fraud while posing as you. In the worst-case scenario, they might get into your online banking and drain your account, creating a nightmare to recover stolen funds.

To stay safe, avoid opening spam emails and never click on unfamiliar links.

Physical Theft

Losing your wallet can do more damage than you think if it ends up in the wrong hands. A thief could use your driver’s license or Social Security card to commit identity theft. Criminals might also target your physical mail to get their hands on sensitive financial details, like your bank account number. One common tactic is change-of-address fraud, where they reroute your mail to steal your information without you knowing.

Remember, everything you do online leaves a digital footprint, and in some cases, a criminal only needs your email to access your personal information. Stay vigilant—whether it’s protecting your wallet or guarding your online activities, keep your defenses up.

While it can be difficult to detect identity theft until it’s too late, there are tactical steps you can take to reduce the risk. No service can eliminate all threats, but with our combination of advanced tools and strategic monitoring, we can detect and alert you to potential credit fraud up to 250X faster than our competitors.

Think of it as having a vigilant lookout, spotting threats before they reach your perimeter

Powered By Defend-ID

features

- Home

- Mortgages

- Homeowners/ Auto Insurance

- Commercial Insurance

- Commercial Lending

- Jodi's Home Warranty

- VetDefender